One of the largest, most prominent USA-based casino operators, the Wynn Limited Resorts company is set to receive a massive bank settlement worth around $41 million as a result of the resolution of lawsuits related to the company’s former CEO and Chairman Steve Wynn’s indiscretions.

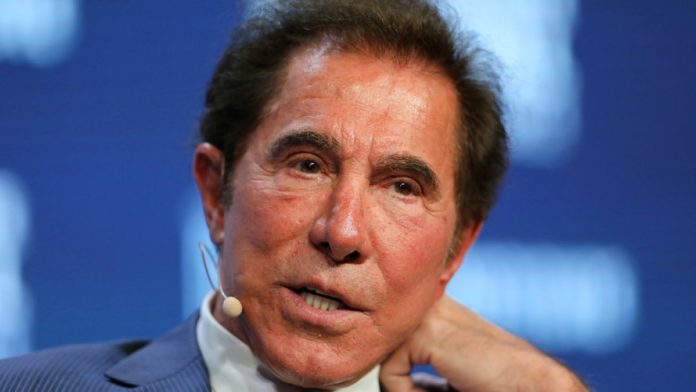

According to one report from the popular local news outlet Las Vegas Review Journal, all of the legal actions against the company’s officials and former CEO and Chairman were filed by its investors back in November and February of 2018. The legal actions were taken amid serious claims that the Wynn Resorts Limited’s stock valuation had been extremely harmed after the emergence of serious allegations against the company’s former Chairman and CEO, seventy-seven-year-old Steve Wynn.

Allegations Against Steve Wynn

Steve Wynn is one of Wynn Resort Limited’s founders. Before founding the company, he was associated with a luxury hotel and casino industry particularly with Atlantic City and Las Vegas-based hotels and casinos including The Mirage Treasure Island, the Golden Nugget and the Bellagio. He helped to launch the casino company which still bears his name back in 2002. He served as the company’s Chairman and CEO since its inception but resigned all of his Wynn Resorts Limited executive roles back in February of 2018.

This move came shortly after one publication was revealed in which Steve Wynn is accused of sexually harassing some of the company’s female workers. The publication also revealed that Steve Wynn allegedly hushed up such allegations previously using private settlements. The former Wynn Resorts Limited’s CEO and Chairman has maintained his complete innocence, but he still decided to sell his entire stake in Wynn Resorts Limited which was around 11.8% for approximately $2.14 billion.

Wynn Resort Limited’s Windfall

Also reported by Las Vegas Review Journal, derivative lawsuits as the ones which were lodged against the former Steve Wynn’s company are usually filled by a corporation’s shareholder. In this case, any kind of proceeds are aimed at the organization. In other words, proceeds do not go to individual investors.

Even though the Las Vegas-based company declared that neither the firm nor its former and current officials and directors had been found guilty of any kind of wrongdoing, the company is still in line to receive a massive bank settlement worth $20 million from Steve Wynn and $21 million from insurers. Besides these cash payments, the related settlement will also require from the company to make some changes related to its bylaws which will separate the company’s Chief Executive Officer and Chairman roles.

It was also reported that the Las Vegas-headquartered company has agreed to start working on strengthening its diversity as well as implementing a significantly enhanced planning procedure when working on replacing its senior executives. Finally, the same news outlet also reported that one part of the settlement will involve the company adopting several trading plans named 10b5-1 for directors and executives who hold firm stock which exceeds $15 in value.

This move, in particular, will allow all of the company’s investors to avoid common accusations related to insider trading simply by establishing an already determine the time required to offload the company’s shares in their possession. It was also reported by the state of Nevada Gaming Control Board that could potentially set an official hearing related to the five-count complaint which was filed previous months against Steve Wynn.